How Two Friends Built a Business That’s Donated Over $16.5 million

Since launching digital ticketing platform Humanitix together in 2016, school friends Adam McCurdie and Joshua Ross have channeled millions of dollars in profits to charitable causes. Here, Adam shares how the American Express® Qantas Business Rewards Card helps them to manage cash flow and fund their global ambitions, with Qantas Points and benefits unlocking huge opportunities.

“My mum thought I was crazy,” says Adam McCurdie (pictured above, right), who’d quit his job to devote himself to the ticketing side hustle he and his best friend Joshua Ross (pictured above, left) had been working on for two years. “Josh stayed on in his job and we shared his salary while I went full-time on Humanitix to really give it a crack. It was all based on trust and a handshake – my mum was worried it would ruin our friendship.”

Mates since high school in Sydney, the pair had been searching for an industry to disrupt that would allow them to dedicate the profits to carefully chosen charity partners. “We wanted to find meaningful work and make a contribution to society,” says McCurdie.

They decided on ticketing software for their social-impact startup because of its potential for swift returns – if they got it right. “We were excited by groups like personal care social enterprise Thankyou and others who were transforming industries into a force for good,” he says. “Software is a super successful industry that makes lots of money but where are all the software social enterprises? We set out to create a ticketing platform and give the profits to the most effective charities.”

Ross eventually quit his job in 2017 to work on Humanitix full-time with McCurdie and by 2020 the duo had started to look at expanding internationally.

McCurdie relied on the American Express Qantas Business Rewards Card to help manage business costs and the significant expenses involved in building and operating a high-tech ticketing company that also offered excellent customer service.

“Putting absolutely everything onto the Card made managing cash flow incredibly simple,” he says. “While as a digital platform we don’t have physical inventory to manage, tech has high costs around infrastructure. We pay all of our technology, services and marketing bills on our Amex Card and as we grow, all of our business travel goes on the Card, too.”

They are able to access a line of unsecured funding with flexible spending power¹, allowing them to make larger payments as they arise, while having up to 51 days to pay for purchases² means they can navigate business costs with ease. “In the early days as we were getting started, putting expenses on the Card really helped contribute to our steady growth.”

Unlock cash flow + Qantas Points

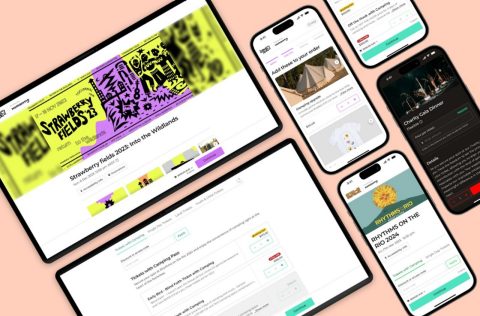

Beyond the feel-good factor, the appeal of Humanitix is that there’s no cost to use it for issuing free tickets. Organisers can set up and manage their own events on the platform and the fees for charities and schools are lower. “We’ve ticketed events for two people at a candle-making workshop in rural NSW all the way up to 120,000 people at the Melbourne International Flower & Garden Show,” says McCurdie.

Once the Australian business was well established, in 2018 Humanitix expanded into New Zealand and then, three years later, into the US. Earlier this year, the company opened its first office in Edinburgh, Scotland to take on the UK market. Now, across Australia, New Zealand, the US and the UK, Humanitix employs a team of 70 staff and is currently actively recruiting to expand further.

Based in Sydney, McCurdie and Ross use their American Express Qantas Business Rewards Cards – and the points they amass – to travel regularly between their international offices. Europe is next in its sights: “We’re planning for operations in Germany, France, the Netherlands and Spain,” says McCurdie.

Receive 150,000 bonus Qantas Points plus $250 in your Qantas Business Rewards Travel Fund* when you apply by 7 October 2025, are approved and spend $6,000 on eligible purchases on your American Express Qantas Business Rewards Card within 3 months of your approval date. T&Cs apply. Available to new American Express Card Members only. Learn more

“Humanitix processes in excess of 20 million tickets a year, and in 2024 alone we donated $10 million to our partner charities – more than double what we donated the previous year,” says McCurdie. “We put a lot of effort into finding the most effective charities with a focus on education and poverty.”

As well as detailed impact reports, Humanitix uploads the receipts for donations, which are amassed from ticketing fee profits, and shares them online to offer customers complete transparency.

“You really wouldn’t think that a ticketing company could be a multi-million-dollar funder of education for disadvantaged kids. But if you’re creative and innovative, you can transform any industry and go far beyond expectations to become a meaningful vehicle for change and positive social impact.”

Unlock the possibilities

The Humanitix co-founders share the tips that helped grow their booming social enterprise. It’s a shining example of how it’s possible to do good and do well.

“The Card helps with your cash flow logistics”

Humanitix puts as many business expenses as possible on its American Express Qantas Business Rewards Card. “It allows us to consolidate the payment of our expenses and gives us visibility on our outgoings,” says McCurdie. Having up to 51 days to pay for purchases² on the Card allows Humanitix to pace out their fixed ongoing expenses and plan for less predictable costs, such as business travel. “From a cash flow perspective it has been fantastic, plus we build up our Qantas Points from our essential expenses.”

Amex Qantas Business Rewards

“Using Qantas Points for business travel helps us control costs”

The travel spend for Humanitix has steadily taken off as the company has expanded operations across four countries – and as a not-for-profit organisation, it’s especially important to save money. “Wherever possible, we use the Qantas Points we earn with our American Express Qantas Business Rewards Card to book flights through Qantas Business Rewards,” says McCurdie. These points mount up fast, with Humanitix earning up to 1.25 Qantas Points per $1 spent on everyday business expenses and 2 Qantas Points per $1 spent on Qantas products and services.³ “We have staff going back and forth between our offices so this has been incredibly beneficial – we’ve been able to book lots of rewards flights and reduce costs significantly.”

“Doing good doesn’t guarantee your success – but innovation does”

“Ticketing is a very competitive industry – we’re up against big Australian players and high-profile Silicon Valley companies,” says McCurdie. “People won’t use us just because we give our profits to charities – we have to keep innovating to make the platform better. Our first event was a small quiz night for children’s charity Variety Australia, which became one of our partner charities. As the organisation has grown, we’ve built out the sophistication of the platform and that has enabled us to offer ticketing for bigger, more complicated events.”

“The Card’s complimentary Travel Insurance is one of the best perks”

Paying for a return airfare on the American Express Qantas Business Rewards Card brings Complimentary Travel Insurance⁴ for the Card Member and their family (Domestic and International Travel Insurance for you, your spouse and your Employee Card Members when you pay for your return trip with your Card. Terms, conditions and exclusions apply such as maximum age limits, pre-existing medical conditions and cover limits). “It’s fantastic to have insurance covered by paying for the flights on the Card,” says McCurdie, who most recently flew to the United Kingdom to set up the business’s newest office. There are no fees for up to 99 Employee Cards⁵, so any Humanitix team member with an American Express Qantas Business Rewards Card will also receive complimentary Travel Insurance when they book and pay for return flights on the Card, pooling the Qantas Points into the central Qantas Business Rewards Account. “We have about five Cards across our team now, which is very helpful.”

“The Card is a must-have when you’re growing your business overseas”

Opening operations in a new country comes with significant set-up expenses. When McCurdie was buying computers for the Edinburgh team, he was confident knowing he could simply use his American Express Qantas Business Rewards Card for the major purchase. “It’s great to know we can use the Card – especially as we expand.”

Receive 150,000 bonus Qantas Points plus $250 in your Qantas Business Rewards Travel Fund* when you apply by 7 October 2025, are approved and spend $6,000 on eligible purchases on your American Express Qantas Business Rewards Card within 3 months of your approval date. T&Cs apply. Available to new American Express Card Members only. Learn more

Discover the Cards that move with you. Explore the latest offers from the suite of Qantas American Express Cards and find the one that’s right for you.

Click here for Terms and Conditions

SEE ALSO: How this Designer Turned Sleep into a Multi-million-dollar Business

American Express approval criteria applies. Subject to Terms and Conditions. Fees and charges apply. All information is correct as at 1 September 2025 and is subject to change. This offer is only available to those who reside in Australia. Cards are offered, issued and administered by American Express Australia Limited (ABN 92 108 952 085). ®Registered Trademark of American Express Company. The Credit Card and Charge Card products referred to in this webpage are not Qantas products and not offered or issued by Qantas but by the relevant credit licensees. The information about the credit products has been provided by the relevant credit licensees and not Qantas. Qantas does not hold an Australian Credit Licence and is not a licensee in relation to the credit activity being engaged in by the relevant credit licensees.

*150,000 bonus Qantas Points + $250 Qantas Business Rewards Travel Fund Offer: Offer only available to new American Express Card Members who apply by 7 October 2025, are approved and spend $6,000 on eligible purchases on their new Card in the first three (3) months from the Card approval date. Eligible purchases do not include Card fees and charges, for example annual fees, interest, late payment, cash advances, balance transfers, traveller’s cheques and foreign currency conversion. Card Members who currently hold or who have previously held any Card product issued by American Express Australia Limited in the past 18 months are ineligible for this offer. 150,000 bonus Qantas Points will be awarded to the eligible Card Member's Account 8-10 weeks after the spend criteria has been met. $250 credit will be issued by Qantas into the Card Member’s Qantas Business Rewards Travel Fund up to 10 weeks after the bonus Qantas Points have been awarded. Bookings made using Travel Fund can only be used for future flight bookings through Qantas Business Rewards; it is non-transferable and cannot be redeemed for cash. Promotional Credits from this offer will be valid for 12 months from the date of issue. Subject to Travel Fund Terms and Conditions. Subject to the American Express® Qantas Business Rewards Card Points Terms and Conditions. $450 annual Card fee applies. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.